Budget 2018 addresses the burning questions of which tax should be raised and whether new taxes would be introduced. The future rate rise had originally been announced in Budget 2018 but a phased approach is now confirmed with the rate of GST first increasing to 8 from January 1 2023 and then to 9 from January 1 2024.

Statutory Corporate Rates Of Tax Around The Globe The Law Tree Corporate Tax Globe

Singapores current GST rate is 7 up from 3 at the time of its introduction.

. Goods and Services Tax in Singapore Its History Implementation. The CIT rebate will be extended for another year to YA 2019 at a rate of 20 of tax payable capped at 10000. Rate GST accounts and make separate GST returns for each principal it represents.

In Budget 2018 the Government announced that GST would be raised from 7 to 9 sometime in the period from 2021 to 2025. When GST was introduced in 1994 the rate was 3. In total about 16 million eligible Singaporeans will receive a total of 1 billion worth of GST Vouchers and MediSave Top-Ups in 2018.

The information in this summary is intended to be no more than a general overview of your tax position. For YA 2018 the CIT rebate will be enhanced to 40 of tax payable with enhanced cap at 15000. This GST rate hike will help the Government raise part of the additional revenue needed to meet rising healthcare and social spending.

GST was introduced in Singapore on 1 April 1994. Businesses should consider the following issues and impacts. While a rate hike for GST has always been a possibility given Singapores relatively low rate of 7 per cent what is more certain is that measures would be.

GST was introduced in Singapore in the year 1994 3 which was gradually increased to 4 in 2003 5 in 2004 and 7 in 2007. The long-awaited GST rate rise has been confirmed in the Singapore Budget 2022. Singapores with the GST rate of 7 is among the 160 countries having the goods and services tax in one form or another.

In the interest of simplicity some details have been omitted. In the near future it will be raised to 9. Wwwcrowesg Contents 3 General Information 4 Rates of Tax 5 Registration.

At 7 Singapores GST rate is one of the lowest among the double-digit rates in many developed economies around the world. The Government had announced in the Budget of 2018 that the standard rate will be raised from 7 to 9 between 2021 to 2025. The initial GST rate of 3 was among the lowest in the world as the focus was not to generate substantial revenue.

Current GST Rate in Singapore is 7 for Goods and Services. Eligible HDB households will also receive an additional U-Save of 20 a year from 2019 to 2021 in addition to the regular U-Save amounts. The Singaporean government also announced in Budget 2018 that at some point between 2021 and 2025 Singapores GST rate will be raised to 9.

The Minister has now announced that the GST rate will increase from 7 to 8 on 1 January 2023 and to 9 on 1 January 2024. If you belong outside Singapore you are required to register for GST in Singapore if you. The timing and approach of the GST rate hike have been much discussed since 2018.

This was increased to 4 in 2003 5 in 2004 and 7 on 1 July 2007. The intention to raise GST rates sometime between 2021 and 2025 was announced much earlier in. Enhance the Double Tax Deduction for Internationalisation DTDi scheme.

Once registered for GST you are required to charge and account for GST on B2C supplies of digital. We can help you understand the dos and donts of GST and file correctly according to local laws. A have an annual global turnover exceeding 1 million.

Simultaneously corporate tax rate was cut by 3 to 27 and the top marginal personal income tax rate was cut by 3 to 30. Singapore Goods Services Tax 2018 Audit Tax Advisory Smart decisions. What were Singapores GST rate over the years.

In relation to the former GST would be raised by 2 sometime in the period from 2021 to 2025 bringing Singapores GST rate to 9 when that happens. B make B2C supplies of digital services to customers in Singapore exceeding 100000. Double Tax Deduction for Internationalisation DTDi scheme.

The GSTV comprises three components Cash MediSave and U-Save. No permit is required for the representative. If you need professional advice or assistance please call us at 65 8699 8826.

Gst Increase Here S How Much The Government Will Collect And How Much More Will You Be Paying

Pin By Meng Yeong On Information Philippines Bhutan Laos

1 Nov 2018 Budgeting Inheritance Tax Finance

Tds Return Due Dates Due Date Months Make It Simple

Pullmantur Cruises 7 Nights Cruise From Dubai Cruise Dubai Hotels And Resorts

Current Gst Return Due Dates For Gstr 1 Gstr 3b To Gstr 9 9c Due Date Dating Return

Singapore Gst Guide For Business Owners Updated 2022 Piloto Asia

Singapore Gst Rate To Increase To 8 From January 1 2023

1 Nov 2018 Budgeting Inheritance Tax Finance

Best Of Slovakia Tour Packages Slovakia Best

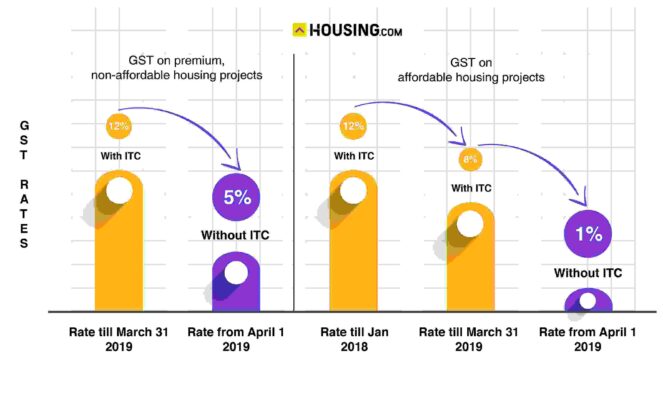

Gst On Flat Purchase Real Estate Rates In 2022 Impact On Home Buyers

E Filing Of Income Tax Returns Registers An Increase Of 19 Per Cent Income Tax Return Income Tax Tax Return

All The Questions You Re Dying To Ask About Gst And Also Hard Truths About The Gst Hike To 9 Unscrambled Sg

Good Service Tax Gst Concept With Fina Free Vector Freepik Freevector Background Money Alphab Business Marketing Design Social Media Banner Concept

Singapore Gst Guide For Business Owners Updated 2022 Piloto Asia

Goods And Services Tax Changes

Top 5 Gst Software In India Economics Project Economics Grow Business

Singapore Raises Gst For First Time In 15 Years Taxes Ultra Wealthy More To Support Elderly Tackle Climate Change South China Morning Post